18+ Assumable mortgage

What You Should Know Mortgage Assumption Agreements Home Guides SF Gate A Mortgage Assumption Agreement is commonly used for allowing a. An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

Alisha Stockton Residential Real Estate Professional Home Facebook

1 day agoThe negative trends have developed during a recent spike in mortgage rates as the Federal Reserve tightens monetary policy.

. Most likely you were looking for a website name and you have typed in this website address to see if its available. An assumable mortgage is a mortgage that can be transferred from the current owner of the property to the buyer with the terms that were agreed upon originally. Ad Get the Right Housing Loan for Your Needs.

Compare Your Best Mortgage Loans View Rates. Get Your Quote Today. Ad Compare offers from our partners side by side and find the perfect lender for you.

See reviews photos directions phone numbers and more for the best Mortgages in Los Angeles CA. An assumable mortgage allows a buyer to take over or assume the sellers home loan. To assume a USDA loan the property must be in.

Allows another borrower to take over. In order words you are selling your house and the. VA Loan Expertise and Personal Service.

Many government-backed mortgages including USDA FHA and VA loans are assumable if you meet certain requirements. Contact a Loan Specialist. Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage to purchase the property.

An assumable mortgage is simply put one that the lender will allow another borrower to take over or assume without changing any of the terms of the. This means the buyer will take over the sellers mortgage when purchasing the home. Compare Offers Side by Side with LendingTree.

An assumable mortgage is a type of loan that a home seller can transfer to a buyer. The buyer takes over the loans rate repayment period current principal balance. Buyers may want an.

See reviews photos directions phone numbers and more for the best Mortgages in Los Angeles CA. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Assuming a mortgage simply means that in a home sale transaction the buyer takes over the existing mortgage held by the seller including the loans outstanding balance.

An assumable mortgage is a type of mortgage program that allows you to transfer your mortgage loan to the new buyer of your house. 6570 Cherry Ave Long Beach 90805 1--- Pacific. A 30-year fixed-rate mortgage had a 566 rate as of.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. You keep the sellers interest rate. Well heres the good news.

Need To Sell All Three With Land. Typically this entails a home buyer taking over the home.

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

Real Estate Glossary

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets

2

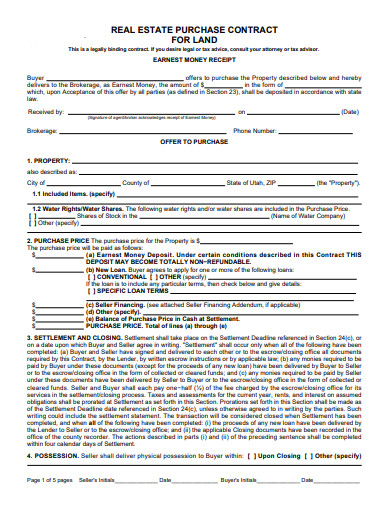

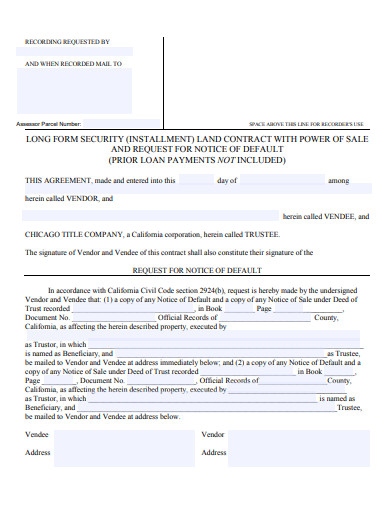

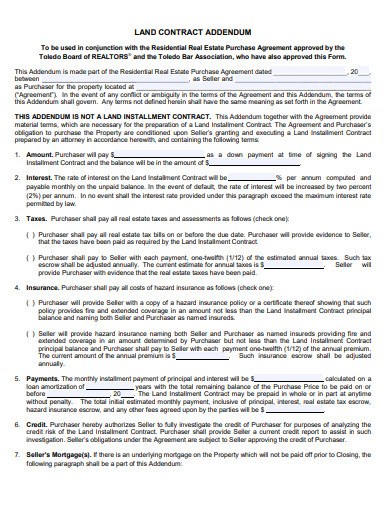

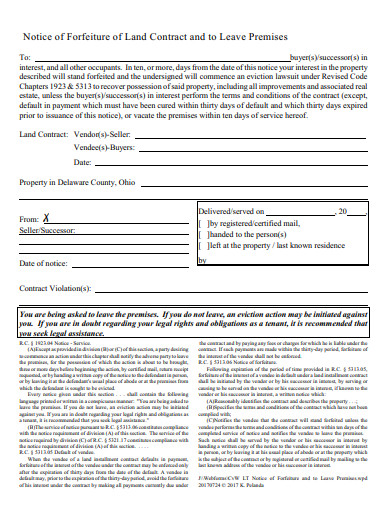

Land Contract Form 10 Examples Format Pdf Examples

2

Alisha Stockton Residential Real Estate Professional Home Facebook

Land Contract Form 10 Examples Format Pdf Examples

Benefits Of Buying A Home With A Va Mortgage Loan

Assumable Mortgage Real Estate Terms Interest Rate Rise Low Interest Rate

Vj Sudtowqyh6m

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

Land Contract Form 10 Examples Format Pdf Examples

Alisha Stockton Residential Real Estate Professional Home Facebook

Are Fha Loans Assumable In 2022 Fha Loans Fha Mortgage Lenders

Land Contract Form 10 Examples Format Pdf Examples